With 8.4 billion connected gadgets worldwide, the Internet of Things is no longer a Sci-Fi concept – it is the reality we live in. What’s more, IoT’s paradigm has recently shifted from cost reduction and effective asset monitoring to…making profit!

Manufacturing companies that use connected devices on-site, for example, report a 28.5% IoT-driven revenue growth. By 2025, the Internet of Things will generate over $11 trillion in economic value – and the use of IoT in the financial services industry seems inevitable.

Internet of Things in Financial Services: Benefits Get Real

1. Increased transparency

By using IoT solutions, banks and financial organizations gain real-time data on their own and their clients’ assets (which leads to effective risk management). Some of the early examples come from the auto insurance industry.

Progressive, one of the largest US car insurance providers, employs OBD devices and machine learning algorithms to study driver behavior and adjust insurance pricing accordingly. The company has made over 1.7 trillion observations and claims its prices are based on “how well you drive – and not the type of your car”.

Also, smart sensors help companies reduce building management system deployment and operating expenses by 30% (and manage property based on the actual foot traffic and room occupancy data); as of now, it costs up to $250 thousand to install a BMS in a 100 thousand square foot office building!

By analyzing biometrics and sensor data, retail banks can also improve the credit underwriting process and target customers with no credit history (although it remains to be seen what type of data will help them evaluate someone’s credit worthiness best);

2. Automation of trading and investment activities

According to Dr. John Bates, CMO for Intelligent Business Operations and Big Data at Software AG, the future of the financial services industry lies in real-time market surveillance and pricing engines enabling companies to monitor traders’ activities on stock markets, social media and communication platforms and adjust their policies accordingly.

Brett King, CEO of Moven, believes most payment and financial transactions will be fully automated in the near future.

Chris Skinner, Chairman of the Financial Services Club, claims the world’s leading financial organizations are currently building the Internet of Value – a global connected environment facilitating M2M trading through bitcoin, mobile apps and smart sensors.

FinTech opinion leaders have high hopes for IoT; why shouldn’t you?

3. Payment transaction security

Smart gadget manufacturers offer multiple tools to secure payment transactions. These include tokens (Visa Token Service), biometrics-based authentication programs (Precise BioMatch Embedded) and the Magnetic Secure Transmission technology paired with mPOS terminals.

Diebold, a US financial and security services corporation, went even further and designeda smart ATM! If you want to withdraw some cash, you should simply schedule a session via a mobile app, walk up to the nearest ATM and choose one of the available verification options (NFC, QR code recognition or iris scanner). The transaction can be completed in just 10 seconds and is much safer than traditional PIN verification.

Forward-thinking software developers even leverage cardiac signature (data gathered through EKG sensors) as a payment ID! In a world where ransomware can bring thousands of computers down, you can’t be too serious about payment data security, right?

4. Improved customer services

There are several ways to increase customer satisfaction with IoT financial services solutions. For example, you can pull a Barclays and bring your mobile app to a smart watch. Some retail banks (Westpac Australia) install beacons to engage customers who walk past their office or come for an appointment. The beacon strategy includes a personal greeting, product offers based on a customer’s previous activities and surveys.

With a totally new approach to loan collateral tracking, smart contracts and risk-free investment decisions, financial organizations can significantly reduce the costs of personal and business loans, thus giving a boost to the global economy.

![]()

IoT in Financial Services: Unlocking the Opportunity

Back in 1999 Kevin Ashton, the man who contributed to the development of the global standards system for sensors and RFID tags and coined the Internet of Things term, described IoT as the global environment where objects (including consumer electronics and things with no built-in connectivity) collect data through sensors and exchange it over a network.

Thus, IoT is all about things which can communicate and provide some measurable data.

And what if data primarily comes from intangible resources? In order to unlock IoT’s potential in the financial services sector, companies should be able to detect data roots in the physical world – for example, correlate a logistics company stock price to the amount of goods shipped over a certain period of time. In order to identify potential IoT use cases, FinTech leaders should also deploy different types of sensors and see which sources of data prove to be useful.

According to Deloitte, the number of IoT sensors that can be potentially used by financial organizations will top $12 billion by 2025 (and that’s 50% of all sensors deployed worldwide).

IoT security is another issue that has yet to be solved.

As of now, 90% of all connected solutions are subject to malware attacks. IoT vulnerabilities mostly result from smart gadgets manufacturers’ reluctance to encrypt data and roll out firmware updates on a regular basis – and that’s why FinTech companies should address the security issue at the early stages of IoT product development.

If you consider using a connected solution for business purposes, do this:

- Address a reliable IoT app development company and outline the details of your project;

- Be prepared to spend some time on research (Proof of Concept and feasibility study will help you evaluate a product’s potential and market appeal);

- Create several IoT product use cases (including scenarios of possible cyber security attacks);

- Make sure your vendor employs certified security experts who will develop a detailed IoT product roadmap with security in mind;

- Don’t forget about hardware: cheap devices with limited computing power won’t be able to support regular firmware updates and provide the desired level of security.

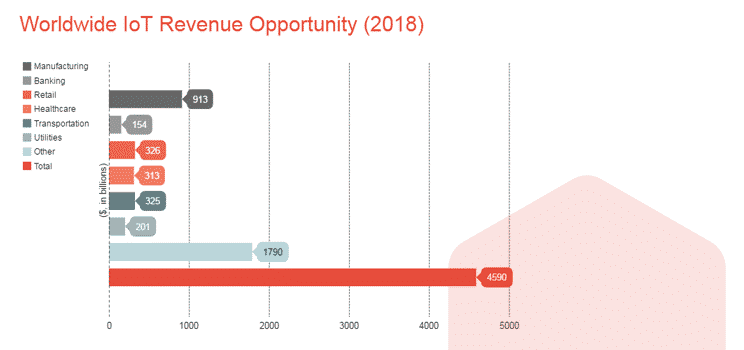

The financial services industry is now among the top 10 sectors investing in IoT solutions. Unless you join your rivals in facilitating the digital transformation today, they might outcompete you tomorrow.

Written by Andrei Klubnikin, Senior Content Manager at R-Style Lab